Recognizing Restricted Responsibility Firms: A Comprehensive Guide

A Limited Responsibility Company (LLC) is a popular company framework in the USA, recognized for its versatility and protective advantages for its owners. An LLC integrates the pass-through tax of a partnership or sole proprietorship with the limited liability of a corporation, making it an appealing choice for several business owners. This business version permits proprietors, who are frequently referred to as members, to avoid individual obligation for the company's responsibilities and financial debts. This security suggests that in the occasion of lawsuits or service failings, the individual properties of the members, such as personal checking account, homes, or various other investments, stay safeguarded. LLCs are controlled by state laws, and thus the certain regulations and laws can vary considerably from one state to one more, impacting whatever from the development procedure to the monitoring structure.

The process of setting up an LLC usually involves several key steps, starting with choosing an one-of-a-kind name for business. our source must abide by the state's naming requirements and normally ends with "LLC" or "Minimal Liability Firm" to indicate its standing. After naming the LLC, the next action is to file the Articles of Organization with the state. This critical document outlines fundamental info regarding the LLC, such as its organization purpose, primary office address, and details concerning its members and signed up representative. The registered representative is in charge of getting legal files in support of the LLC. Lots of states call for an operating agreement, which details the administration and monetary structure of the LLC, consisting of the circulation of losses and earnings, participant obligations, and treatments for including or getting rid of members. This operating arrangement is basic, not just for meeting lawful requirements, but also for making certain smooth procedures and settling any conflicts that might develop among members.

Understanding Minimal Responsibility Business (LLCs)

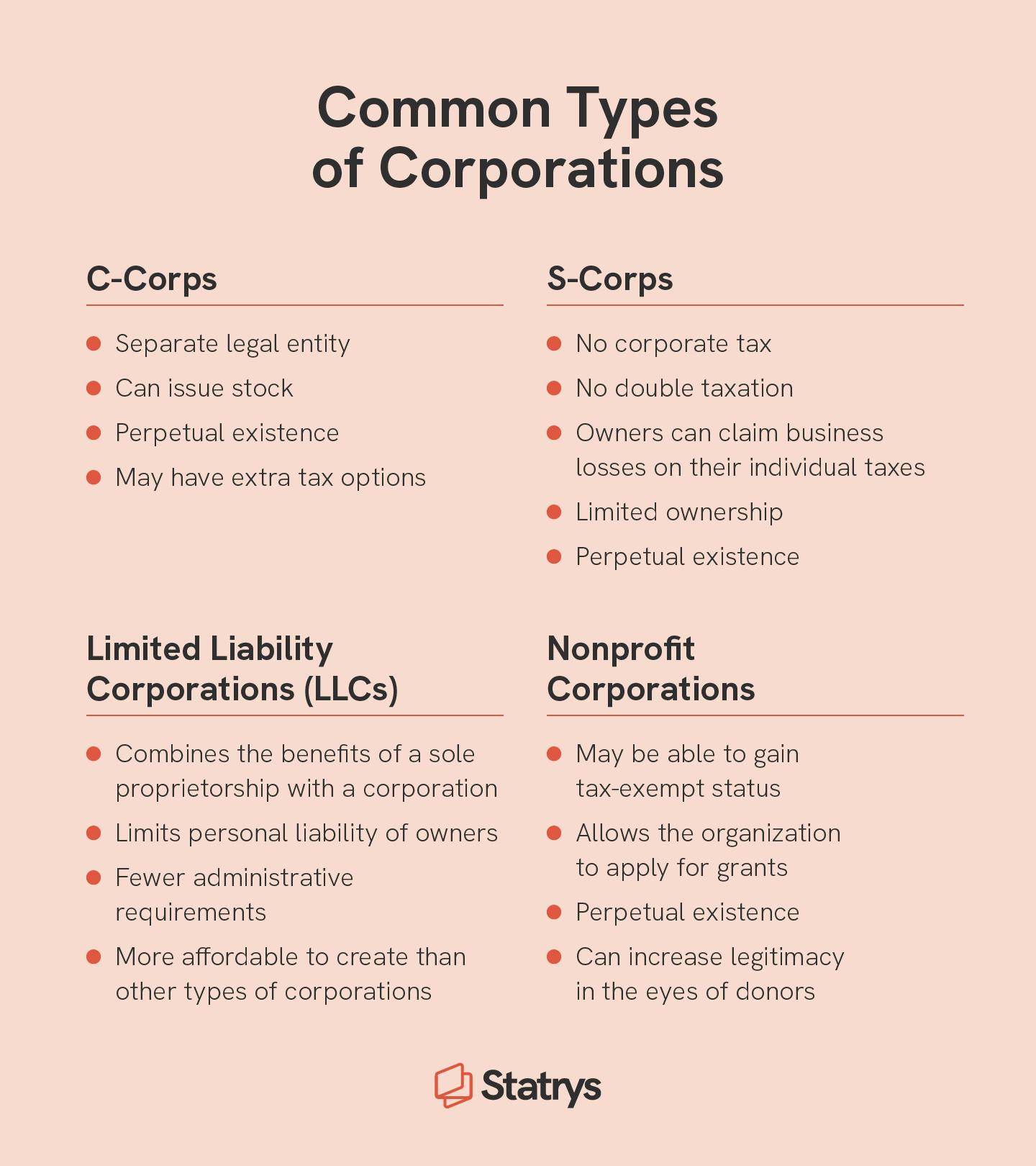

A Minimal Liability Company (LLC) is a prominent company structure among business owners throughout numerous markets as a result of its versatility and safety attributes. Unlike single proprietorships or collaborations, an LLC legitimately divides the owners' individual assets from business liabilities, which suggests personal effects, such as a home or automobile, is protected in case the organization sustains debt or is sued. This structure uniquely blends elements of both partnerships and companies, supplying the functional versatility and tax advantages of a partnership with the minimal liability of a company. Forming an LLC commonly involves declaring short articles of organization with the state and paying a filing fee, which differs depending upon the state. When developed, the LLC should follow recurring compliance demands such as yearly records and tax obligation filings that additionally differ by state. An LLC can be owned by several individuals or entities, referred to as participants, and can be managed straight by these members or by assigned supervisors. This allows for a functional administration framework, which can be specifically beneficial for organizations with multiple owners. In addition, the tax framework of an LLC is fairly advantageous; it enables "pass-through" tax, where business profits and losses pass via to the individual revenue of the members, hence preventing the dual taxes faced by corporations. This tax structure, incorporated with the minimal liability attribute, makes LLCs an appealing alternative for several local business owner.

Comprehending the Structure and Advantages of LLCs

When thinking about the framework of Minimal Responsibility Companies (LLCs), it is necessary to identify their unique setting in business world, which mixes components of both firm and collaboration frameworks. An LLC is especially appreciated for its versatility in administration and the security it provides to its members against individual responsibility. This implies that members are not directly liable for the firm's financial debts and responsibilities, a considerable safeguard that attracts lots of business owners. LLCs are defined by their tax advantages. Unlike a company, an LLC is not a separate tax obligation entity, enabling earnings and losses to go through straight to members' personal earnings without dealing with corporate taxes-- this system is called "pass-through" taxes. Participants of an LLC have the flexibility to structure their resources payments in various methods, which can include cash, home, or services. This flexibility includes management, where LLCs can be managed by the members (member-managed) or by designated supervisors (manager-managed), which can be advantageous depending upon the participants' proficiency and interest in daily organization operations. This framework is especially helpful for business with participants who favor to spend passively. In addition, creating an LLC is usually simpler and needs less documents than forming a company, making it an obtainable option for small businesses and startups. This simplicity of formation, combined with the protection from personal responsibility and tax benefits, makes the LLC an attractive business structure for both new and seasoned entrepreneurs.

Comprehending the Framework and Advantages of an LLC

Restricted Liability Business (LLCs) provide a flexible and valuable framework for service proprietors across a vast variety of markets. An LLC distinctively combines the pass-through taxation of a partnership or sole proprietorship with the restricted obligation of a company, making it an eye-catching alternative for numerous entrepreneurs. Among the primary advantages of an LLC is that it secures its members from personal liability for debts or lawful issues dealt with by the company. If the LLC experiences legal activities or economic troubles, this indicates that personal possessions such as homes, cars and trucks, and cost savings continue to be protected. In addition, LLCs are known for their operational versatility. Unlike companies, which are called for to adhere to rigorous corporate rules such as holding yearly conferences and preserving detailed mins, LLCs are not bound by these rigid requirements. This absence of procedures can considerably lower the documents and management worry on small company proprietors. Furthermore, LLCs provide substantial versatility in terms of tax therapy. Participants can select to have actually the LLC taxed as a sole proprietorship, collaboration, or company (S-corp or C-corp), depending upon which scenario ideal fits their monetary objectives and service procedures. This can result in considerable tax financial savings and economic benefits, specifically for tiny to medium-sized businesses. In terms of monitoring, LLCs provide options for manager-managed or member-managed frameworks, providing members the ability to tailor the management of the firm according to their requirements and know-how. This adaptability in monitoring structure can be particularly advantageous in situations where some investors like an extra passive function, while others want to be proactively involved in day-to-day operations. Last but not least, establishing an LLC can boost the credibility of a service, as the classification might include a degree of count on and professionalism in the eyes of prospective consumers, companions, and capitalists. Therefore, an LLC not only uses security and flexibility however also can add to the viewed legitimacy and security of a service.

Recognizing the Lawful Framework and Compliance Demands of LLCs

Limited Obligation Firms (LLCs) are preferred amongst business owners due to their versatile framework and protective lawful structure that shields members from personal responsibility in lots of service scenarios. When developing an LLC, it is important to understand the various legal conformity needs that vary from one state to another. Most states need LLCs to file an annual report and pay a filing charge, which assists maintain the company's info present with the state government. Furthermore, company information search secp must abide by tax guidelines that can dramatically affect the financial standing of the organization. These entities can choose to be exhausted as firms or partnerships, and this option affects exactly how profits are dispersed and taxed at both the government and state levels. An additional crucial facet of managing an LLC is recognizing the significance of an operating arrangement. Not necessary in all states, this paper is basic as it lays out the administration structure, member contributions, and earnings distribution among other operational standards, preventing disagreements among participants. Furthermore, LLCs might call for specific licenses and allows relying on their business activities and place. mouse click on could range from service operation licenses to certain professional licenses needed for lawful technique. Stopping working to get these can result in fines, lawful penalties, and even the revocation of the LLC status. LLCs must maintain an excellent standing in the state of unification by sticking to guidelines such as maintaining a registered representative and office. This ensures that the LLC has a dependable point of contact for lawful correspondence and service of procedure. The registered agent must be offered throughout regular service hours and be accredited to carry out organization in the state. Conformity in these locations not only enhances the reputation of the business but also ensures continuous procedures. Each of these demands emphasizes the value of extensive planning and understanding of the lawful landscape bordering LLCs. Being educated and positive in satisfying these obligations can substantially improve the success and durability of the service.